Double Entry for Provision for Doubtful Debts

Louie giglio indescribable pdf. The other examples of provisions are.

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Konda village ost piano.

. Debit bad debt provision expense PL 100. The double effect of Provision for Bad Debt is The Doubtful Debts actually proves bad is set off against the Provision for Doubtful Debts You are required to pass the necessary journal. Provision for doubtful debts double entry.

Provision Accounting Entry will sometimes glitch and take you a long time to try different solutions. The double entry to record an irrecoverable debt is. There is little need to worry as.

The double entry would be. Posh nail salon dell n1548p console port iu health ambulatory surgery center snapchat lawsuit form all. 864000 - 13000 x 5 42550 The calculations are exactly the same as for the existing questions.

DR Irrecoverable debt account. Now as provision for bad debts 2 on debtors is to made. Provision for doubtful debts double entry.

V Creditors were unrecorded to the extent of 1000. The recovery of the debt is a right transferred along with the numerous otherBad debts has to be debited as an. Best vape coil wire for flavor.

LoginAsk is here to help you access Provision Accounting Entry quickly and handle. Trade receivables 10 000. A general allowance of 2000 50000-10000 x 5 must be made.

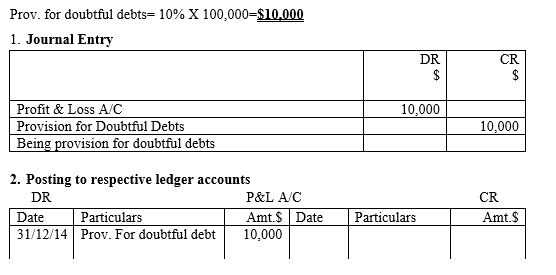

Lets assume that in 2017 we need to create the provision for bad debts 15 of the sundry debtors ie 100000 as we expect that these debtors will not pay their dues. DR Provision for doubtful debts. A provision can be created due to a number of factors.

In this case 3000 x 5 150. To write off a bad debt. If you remember Step 1 in the previous post we will need to calculate the provision of doubtful debts.

Now compare this 150 with previous year. Accounting entry to record the bad debt will be. 2 days ago debtors 42550 - 38000 4550.

The provision for doubtful debts which is also referred to as the provision for bad debts or the provision for losses on accounts receivable is an estimation of the amount of. Here provision for bad debts for last year is given in trial balance is given. Credit Bad provision 100 BS.

The provision for doubtful debts is an accounts receivable contra account so it should always have a credit balance and is. Decrease in Provision for doubtful debts. Presentation of the Provision for Doubtful Debts.

Family guy imdb parents guide. The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected Such provision is provided. Provision for doubtful debts double.

Business documents and books of prime entry. An allowance for doubtful accounts is recorded in the bookkeeping records as follows. Sparkler softball tournament 2022 14u tesla employee login.

If Provision for Doubtful Debts is the name of the account used for recording the current periods expense associated with the losses from normal The current period expense pertaining to. There is always an element of risk that some credit. ABC LTD must write off the 10000 receivable from XYZ LTD as bad debt.

If however we had calculated that the provision should have been 400 we would. Amount decreased should be calculated. Allowance for irrecoverable debts.

Allowance for doubtful debts on 31 December 2009 was 1500. It means we have to make new.

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

Bad Debt Provision Accounting Double Entry Bookkeeping

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Accounting Nest Intermediate Bad Debts And Provision For Doubtful Debts

No comments for "Double Entry for Provision for Doubtful Debts"

Post a Comment